While the Bank of Canada publicly muses about adopting negative interest rates on Government Bonds as a policy tool to stimulate economic growth, the Bank of Japan recently cut its benchmark interest rate below zero, joining several others including the European Central Bank in the negative interest rate club. According to the February 6th issue of The Economist, almost one quarter of the world’s GDP now comes from countries with negative interest rates.

So what is a negative interest rate? Basically, a negative interest rate means that you are giving your money over to a bank or government and paying them for the privilege of holding your bank deposit or government bond!

When you factor in inflation (made worse by a declining Canadian dollar) and any taxation on earned interest income, Canadians are losing purchasing power and slowly getting poorer by the day.

This is a big deal when you consider late January media reports that Canadians are sitting on cash savings of about $750 billion or about $75 billion more than is normal. That excess cash savings of $75 billion is money that would normally be invested in the economy to generate higher returns and economic growth.

On the other side of the coin, Canadians are benefiting from these record low interest rates on all manner of consumer debt including car loans and historically high mortgage debt. But how much lower can rates go and when will they start to rise and impact carrying costs?

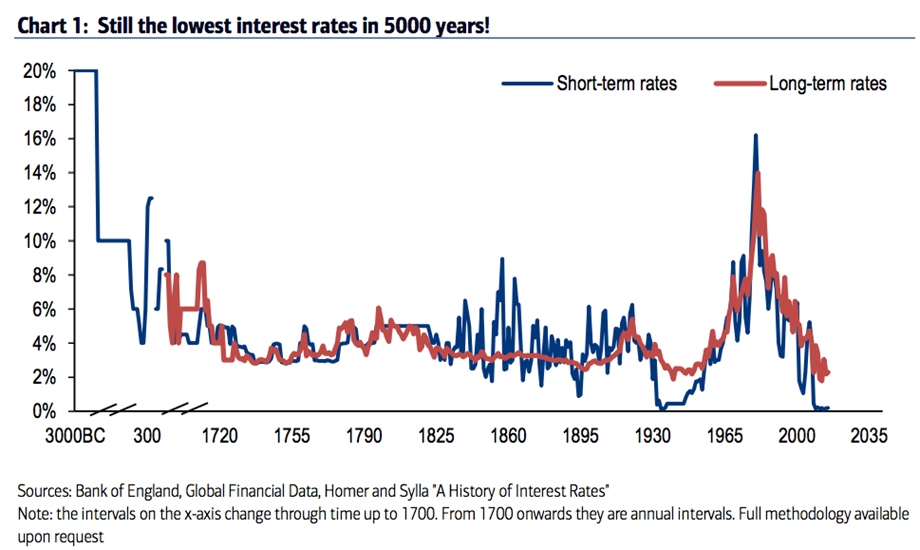

To put things into perspective, a recently released Bank of England study shows that current interest rates are the lowest in 5000 years – or in fact in recorded history!

As a result, using lower interest rates as a policy tool to stimulate economic growth is nearing its practical limits. Consumers will react to bank attempts to charge fees for small cash deposits by hoarding cash at home rather than in the bank amongst other options, notes The Economist magazine.

So why are rates so low? Governments around the world are fighting deflationary economic pressures by keeping rates low and trying to stimulate credit growth, spending and ultimately economic growth.

Ultimately, consumers are being given the message to take their cash and spend it or invest it in ways that are outside of their normal risk comfort zones, which creates a challenge for Canadians looking to generate low risk and safe investment income. The Canadian people are stretching for yield beyond what they would normally consider to be a conservative investment, along with the active encouragement of governments deathly afraid of the consequences of a mild deflationary environment slipping into a full-blown regional or global depression.

Thankfully, there are options for you to consider in deploying your hard earned cash, which include paying off debt, avoiding financing consumer purchases whenever possible and considering a range of investment tools such as mutual funds, segregated funds, annuities, and other alternative products that have been created since the 2008 credit market meltdown.

Call us today for an appointment to review some of the various investment options for your hard earned cash!

Do you have questions about your

investment strategies?

Contact our office today !

Copyright © 2016 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.